Customer Value Drives Your Business

Understanding the value of your customers to your business is the most important factor when looking for ways to grow your business. Small business owners should learn to calculate the real drivers of their business: Customer Value.

When small business owners understand the importance and value that each customer brings to their business they can begin to identify ways in which they can grow their business. In understanding the true value of your customers you can:

- Identify where you should spend your advertising budget

- Determine which customers to invest in

- Promote your products and services more effectively

- Mange your pricing structure to extract more value

- Identify unprofitable customers

- Understand where to cut costs and investments that are not generating growth

Overall, a good understanding of the value of your customers and their expected lifetime value (LTV) can help small business owners view the value of their business more effectively and increase the value of their business going forward.

Lifetime Value of Your Customers

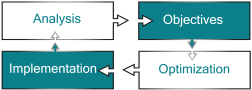

Here’s how you can develop a detailed understanding of the lifetime value of your customers:

#1 Calculate the profit contribution of each customer in the current year

Determine your revenue per customer less any costs to service that customer. If you don’t have customer level financials you should do your best to estimate the value of each customer by customer type, as a customer that buys a low-end product or service will be less valuable than one who buys a high-end product or service.

#2 Develop a realistic estimate of how long each customer remains a customer

The duration you have with your customers is more important in understanding the true value of each new customer. Determining which customers will be more loyal and which are likely to be repeat buyers can be difficult, but you should have metrics that will allow you to estimate this duration over time.

#3 Estimate the cost to acquire or retain the customer

Gaining some customers may necessitate large discounts or heavy marketing, but cost little or no effort to retain. Other customers may require a costly reselling effort every month. Being able to estimate the value of these various customer types on a yearly basis is necessary to determine their true value. – Estimate the cost of this on a yearly basis.

#4 Do the math

Build a simple cash flow model in excel combining yearly contribution projections, the costs to acquire or retain customers, and then continue the cash flow projection for the estimated life of the customer relationship. Be sure that you subtract an “overhead charge” for your total operating costs and include any capital costs if customers require incremental capital investment (e.g., working capital or equipment). Discount future years at a reasonable cost of capital (8-10 percent is usually a good number to use—no reason to get too technical).

Most businesses can be surprised by how many customers are unprofitable when they create a “fully loaded” estimate of customer profitability. Businesses may also be surprised to find that there can be drastic differences in the value of various customers and segments.

Using these calculations of customer value may cause you to question many of your previous investments, but it can also give you a better view of where to allocate future investments in your small business. If you need the expertise of a marketing professional to manage your advertising, help you determine the value of your customers or with help developing a online marketing plan or campaign Patina Marketing at 805-380-5494 or by email.